A Mobile Gaming Saga: From Early Success to Acquisition

Gameloft's story is a fascinating case study in the volatile world of mobile gaming. Their journey, marked by periods of explosive growth followed by significant challenges, culminates in a major corporate acquisition. This narrative explores their rise, strategic shifts, financial hurdles, and eventual integration into Vivendi, offering valuable insights into the mobile gaming industry. How did a company that once boasted 2 million daily App Store downloads find itself navigating financial difficulties? The answer lies in a complex interplay of market forces, strategic decisions, and the ever-evolving landscape of the mobile gaming market.

The Early Years: Dominating the App Store

In the nascent days of mobile gaming, Gameloft emerged as a prominent player. By 2009, they had already sold over 200 million games, achieving a remarkable 2 million daily downloads on the App Store. This early dominance translated into a substantial net worth, solidifying their position as a major force. Their initial success was built upon a model of rapid game development and release, capitalizing on the burgeoning demand for mobile entertainment. However, this early strategy also presented weaknesses. Their almost exclusive focus on Apple's iOS platform, neglecting the rapidly expanding Android market, suggests a potential missed opportunity for even greater growth. Additionally, their reliance on titles mimicking popular console games, while lucrative in the short-term, may have hindered long-term innovation and brand differentiation. Was this early reliance on a single platform and a strategy of imitation a sustainable model for long-term success? Time would tell.

Navigating Change: A Shift in Strategy

By 2014, Gameloft recognized the need for a strategic pivot. They announced a shift towards developing fewer, higher-quality games, a departure from their previous high-volume approach. This calculated risk aimed at enhancing brand reputation and attracting a more discerning player base. However, this transition came with short-term financial consequences. The shift to quality over quantity, while strategically sound, likely contributed to decreased revenue in the immediate aftermath of the announcement. This highlights the difficult balancing act companies face between aggressive growth and sustainable development. What were the long-term implications of this calculated risk based on the company's history? Was the shift successful in the long run? Was the change sustainable?

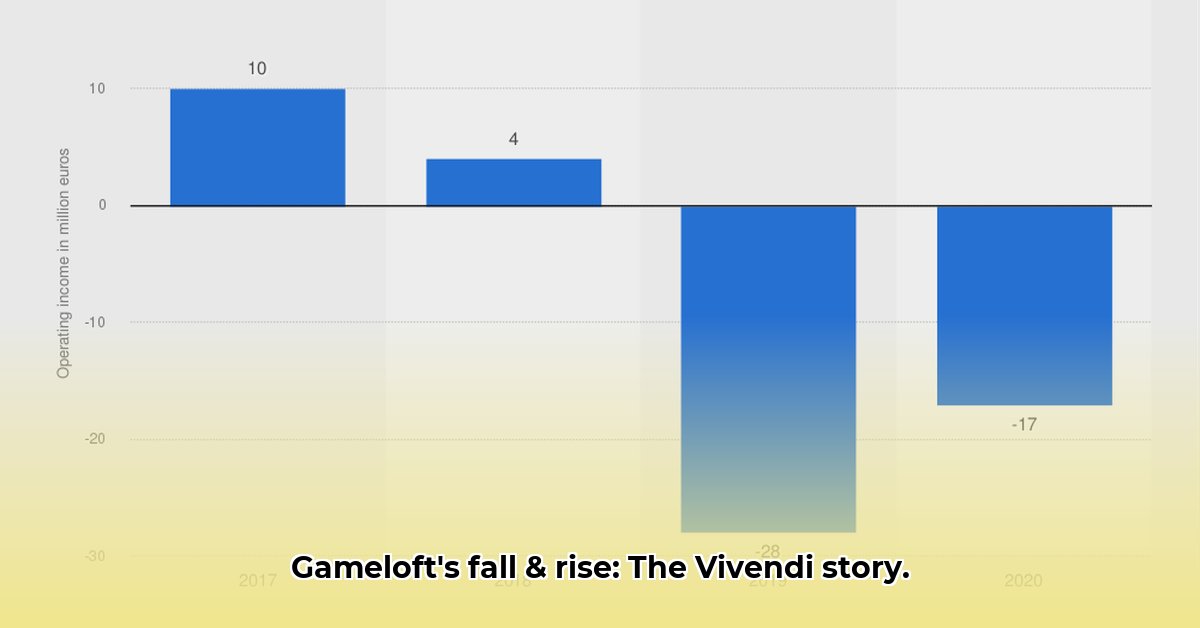

Financial Challenges and Restructuring

The transition proved challenging. In 2015, Gameloft reported a net loss of €16.6 million, a stark contrast to their previous years of success. This significant setback necessitated a period of restructuring, including studio closures and layoffs, underscoring the unpredictable nature of the mobile gaming market. This period serves as a cautionary tale for even the most established companies, emphasizing the importance of adapting to market changes and managing resources efficiently. How did the company's financial performance change year over year during this period, and what factors contributed to the significant downturn? The answers provide crucial lessons for navigating financial fluctuations within an industry known for its cycles of popularity and rapid technological advancements.

The Vivendi Acquisition: A New Chapter

In 2016, Vivendi, a major media conglomerate, acquired Gameloft. This acquisition, though initially met with some resistance, marked a significant turning point, ushering in a new era for the company. The founder stepped down, initiating a new phase of restructuring and strategic direction under Vivendi's umbrella. The details of the acquisition and its immediate impact on Gameloft's net worth remain somewhat opaque due to the complexities of the deal. However, this transformative event significantly altered the company's trajectory and highlights the vulnerabilities of even successful companies within a rapidly evolving industry. What are the long-term implications of this new era, and what will it mean for Gameloft's future endeavors in the mobile gaming space?

Key Takeaways from Gameloft's Journey

- Early success doesn't guarantee long-term viability: Gameloft's initial triumph underscored the importance of adapting to market shifts and embracing innovation.

- Strategic pivots carry risks: The shift towards higher-quality games, while ultimately necessary, resulted in short-term financial setbacks.

- Market consolidation and corporate acquisitions are common: Gameloft's acquisition by Vivendi highlights the competitive dynamics of the mobile gaming industry.

The Gameloft saga serves as a compelling case study, offering valuable insights for aspiring entrepreneurs and established businesses alike. Their story continues to unfold, showcasing the complexities and dynamism of the ever-evolving mobile gaming landscape.